En résumé

Altarea publie une ANR de liquidation diluée en utilisant sa propre méthodologie (principalement DCF appliquée aux activités de développement). Le GAV manque de détails formels et n’est pas publié selon les normes EPRA. La structure de la part du FFO du Groupe n’est également pas détaillée.

Nous fournissons des informations analytiques, en reconnaissant la granularité limitée des informations publiquement disponibles, pour faciliter une évaluation plus précise d’Altarea. Ceci se reflète dans notre remise de gouvernance de 10%.

Partenariat

Les statuts prévoient la dissolution du partenariat d’Altarea (commandite en français), compensée par l’émission de 120 000 nouvelles actions, représentant 0,55% du capital. Altarea indique que cette dilution modérée couvrirait également la dissolution de la commandite dans Altareit. Nous avons vérifié que la compensation du partenaire n’est pas excessive (voir section Gouvernance). Par conséquent, malgré l’existence du partenariat, nous ne voyons aucune raison d’appliquer une remise spécifique à Altarea dans son ensemble.

Politique de dividende

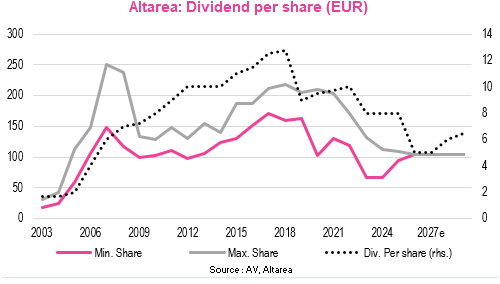

Le dividende en espèces versé aux actionnaires minoritaires influence considérablement le statut boursier. Depuis 2006, l’AGA a approuvé 2,5 milliards d’euros de dividendes, représentant un taux de distribution de 77% du FFO, avec 1,5 milliard d’euros distribués en espèces, soit 48% du FFO. Le milliard d’euros restant provient principalement du dividende en actions, total ou partiel, choisi par les actionnaires de référence, qui détiennent actuellement 69% du capital. Cette différence doit être considérée dans le contexte de la capitalisation boursière actuelle de 2,5 milliards d’euros.

Évaluation DCF

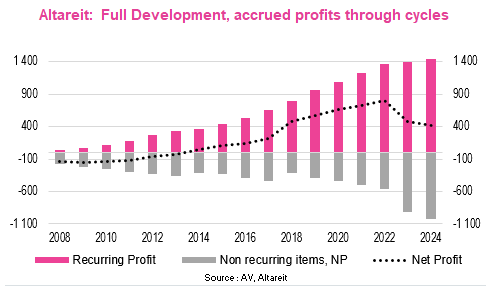

Un modèle DCF a une pertinence limitée pour les sociétés immobilières. Les actifs immobiliers de détail constituent l’essentiel de la valeur d’Altarea. C’est également vrai pour les modèles de développement, dont la performance économique est très cyclique. Nous préférons l’approche GAV/NAV à l’évaluation DCF.

GAV / NAV

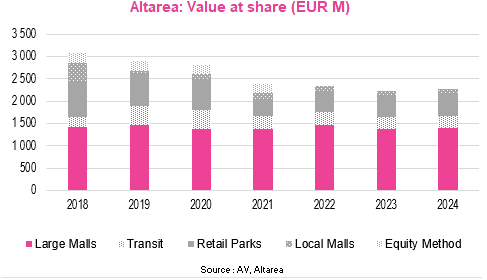

En raison des données publiques limitées, nous supposons que 73% de la dette consolidée d’Altarea concerne ses actionnaires, ce qui implique que les actionnaires minoritaires sont sous-endettés. Nous évaluons le GAV de détail à la valeur d’évaluation de 2024 de 2,1 milliards d’euros (part du Groupe, hors taxes de transfert), en appliquant une remise de 5% (100 millions d’euros) pour refléter les opportunités d’arbitrage actuelles pour des actifs équivalents.

Nous évaluons les actifs de développement résidentiel et tertiaire sur la base d’un multiple d’EBITDA de mi-cycle pour chaque segment. Nous n’ajustons pas les actifs incorporels, qui sont modérément significatifs chez Altarea.

Tous les actifs résiduels en méthode de la participation et les activités de développement sont évalués ensemble à une VE de 1,7 milliard d’euros, y compris les plus-values latentes (AV est.) sur les projets de centres de données et de logistique, détenus à 100% par Altarea.

Minorités, hybrides, méthode de la participation, IFRS 16 & autres

Les intérêts minoritaires sont principalement dans l’immobilier de détail (68 millions d’euros de FFO récurrent dans ce segment contre 15 millions d’euros pour le reste du groupe en FY 23). Nous considérons que les évaluations indépendantes annuelles fournissent une juste valeur marchande en termes de mark-to-market, en retenant leur valeur comptable de 1,2 milliard d’euros. Les minorités sont donc dotées d’un rendement FFO de 6,6%.

Les informations publiques sont insuffisantes pour déterminer l’ampleur de la dette spécifique dans les segments en méthode de la participation. Un ratio EPRA LTV offrirait plus de précision dans l’étude des méthodes de participation.

Il y a 0,2 milliard d’euros de titres hybrides (TSDI, notes subordonnées) payant 3% à perpétuité. Les agences de crédit les considèrent comme des équivalents de capitaux propres car ils sont remboursables après la dette notée. Nous les considérons comme 100% de dette dans l’évaluation, malgré leur valeur marchande théoriquement inférieure à leur valeur comptable. Les prêts d’actionnaires sont traités comme une dette en espèces.

Nous considérons les billets de trésorerie comme une dette, mais depuis 2024, il n’y a pas de programme NEU-CP en raison de taux à court terme plus élevés. Dans notre analyse des risques (ratios ICR et ND/EBITDA, méthodologie AV), les loyers sortants estimés payables par l’entreprise concessionnaire sont déduits de l’EBITDA (environ 15 millions d’euros de charges financières selon l’IFRS 16 sont déduits de l’EBITDA récurrent publié par Altarea).

Évaluation historique et méthodes d’évaluation alternatives

Pour les promoteurs immobiliers, les capitaux propres comptables servent souvent de point de référence pour la capitalisation boursière, que nous surveillons comme un signal potentiel de point d’inflexion. Cet indicateur ne semble pas positif pour 2025.

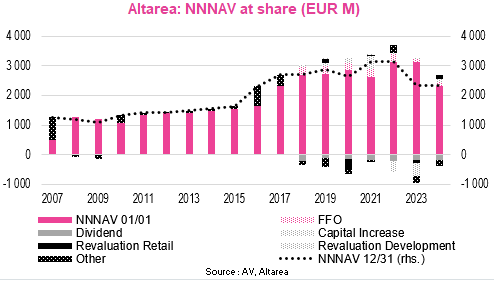

L’ANR par action d’Altarea (méthodologie de l’entreprise, nominale et nette de la dilution du dividende en actions) revient souvent à des niveaux nominaux similaires au bas du cycle : 112 € en 2005, 109 € en 2009, 124 € en 2014 et 112 € en 2023. L’effet de levier est créé pendant la montée du cycle, en particulier lorsque les bénéfices du développement résidentiel et tertiaire coïncident.

Au cours des vingt dernières années, la valeur nominale par action au bas du cycle a été presque constante, avec la plupart des rendements des actionnaires provenant des dividendes, complétés par des rendements potentiels (plus-values latentes) pendant les phases de reprise ou les taux d’intérêt bas.

Notre modèle d’évaluation n’intègre pas une méthode de remise des dividendes. Le dividende est actuellement supérieur au FFO d’Altarea, ce qui remet en question sa durabilité. Altarea a guidé pour un dividende stable de 8 € par action pour 2025, payable en 2026. Nous admettons volontiers qu’il reste une possibilité de maintenir un dividende d’environ 8 € p.a. sur une période de transition, potentiellement de plusieurs années, en cas de série de plus-values sur les opérations de développement dans les segments Logistique ou Data Centers. Ces plus-values pourraient être de taille assez significative à notre avis, mais il reste à voir si ces activités peuvent être matériellement converties en opérations récurrentes apportant des bénéfices réguliers à long terme (c’est-à-dire “FFO récurrent”). En ce qui concerne le court terme, nous pensons que 8 € dépasserait encore le FFO en 2025-26. Nous incluons la création d’actions nouvelles correspondante en 2026 dans nos estimations.

Au-delà de cela, nous alignons le dividende sur un taux de distribution durable de 75-80% du FFO publié prévu, ce dernier étant principalement basé sur les segments “traditionnels” d’Altarea, considérant ainsi une faible contribution des plus-values futures. Nous ne prenons pas en compte les nouvelles émissions d’actions dans les années à venir. Notre attente de dividende au-delà de 2026 (inférieure à 6 €) est nettement inférieure à la prévision à long terme d’Altarea, qui était de 10 € en 2023, ajustée à 8 € payable en 2025 et 2026. Nous envisagerons plus tard de réviser à la hausse le niveau de dividende que nous considérons comme durable si : i/ le redémarrage du Résidentiel est plus fort que prévu actuellement ou ii/ nous sommes convaincus que les plus-values sur le segment tertiaire peuvent être considérées comme plus récurrentes.

Si la direction maintient un dividende nominal de 8 € par action, payable en espèces, cela représenterait un rendement de dividende en espèces d’environ 8% au cours actuel de l’action pour les actionnaires minoritaires. Cependant, il y a un risque de réduction du dividende nominal si les taux d’intérêt restent élevés. Un nouvel ajustement pourrait affecter le cours de l’action d’Altarea par des changements dans son statut boursier : un dividende de 5 €, par exemple, représentant un rendement d’environ 5%, ne serait plus différenciant.

Paramètres latéraux et évaluation des risques

Nous discutons des paramètres d’évaluation supplémentaires dans les sections Gouvernance et Environnement. En incluant toute la dette d’Altarea, nous estimons que le LTV EPRA est supérieur à 42% (28% dans la méthodologie orientée crédit d’Altarea). Ce niveau reste raisonnable, en supposant que le développement des affaires se redresse dans les années à venir, avec un EBITDA se rapprochant des niveaux de mi-cycle.

À long terme

Une observation à long terme d’Altarea montre que le principal bénéfice de l’actionnaire provient des dividendes versés depuis l’IPO. Au sommet du cycle précédent, les capitaux propres par action étaient de 148 € en 2007. Ils sont de 77 € en 2024, plus proches du bas du cycle. Il s’agit d’une évaluation nominale avant prise en compte de l’inflation et après déduction de l’augmentation du nombre d’actions largement due aux dividendes en actions.

Statut boursier

Avec un flottant de 20% (environ 0,5 milliard d’euros), Altarea est positionnée comme une petite capitalisation française avec une faible liquidité. L’action bénéficie d’une prime en raison du rendement du dividende en espèces offert aux actionnaires minoritaires. Ce dividende en espèces est soutenu par le bloc majoritaire, qui reçoit actuellement 75% de ses dividendes en nouvelles actions. La rémunération des actionnaires minoritaires sur la base du dividende en espèces actuel serait d’environ 53 millions d’euros par an, un montant que nous considérons comme durable s’il est exprimé par rapport au FFO, en ignorant le bilan.

Tant que le dividende nominal reste élevé, Altarea bénéficie de son statut de rendement du dividende, qui est favorable au cours de l’action.

Augmentation de capital & dilution

Altarea a déclaré qu’elle n’aurait pas besoin de liquidités fraîches dans un avenir proche. Il n’y a actuellement pas d’instruments dilutifs substantiels en circulation. L’option des actionnaires de référence pour le dividende en actions démontre néanmoins un besoin de soutien du bilan.

Prix cible vs. ANR

Au sommet du cycle en 2021-22, l’ANR publiée était de 3,1 milliards d’euros contre 2,3 milliards d’euros actuellement. La différence entre l’ANR et notre prix cible étant d’environ 0,3 milliard d’euros, elle se compare à un GAV de 100% de 5 milliards d’euros selon la méthodologie d’Altarea. Cette différence est principalement due à une approche plus conservatrice de l’évaluation de la division Développement.