Pros

- Cementir is about white cement, a niche that offers growth and better margins as a higher value-added product. It controls 20% of the addressable market

- It has an excellent record at pivoting assets and making those sweat with Denmark, the US and Belgium as the current hubs

- Cementir Holding is well exposed to the Turkish market, which is set to supply cement for Ukraine and Syria's reconstruction due to significant overcapacity

Cons

- Absolute market size is capped in white cement meaning that Cementir relies on its Belgian and Danish assets to grow local grey cement franchises

- As a family business, it leaves no room for third-party openings and suffers from a limited float

- Currency devaluations in Turkey and Egypt remain a key concern, as they significantly weigh on the company's results despite the positive volume trends in both markets

| | |

|

12/23A

|

12/24A

|

12/25E

|

12/26E

|

12/27E

|

|

PER ajusté (x)

| | |

6,04

|

7,63

|

14,3

|

13,2

|

13,3

|

|

Rendement net (%)

| | |

3,57

|

2,83

|

1,48

|

1,48

|

1,48

|

|

VE/EBITDA(R) (x)

| | |

2,69

|

3,23

|

6,33

|

5,77

|

5,18

|

|

BPA ajusté (€)

| | |

1,30

|

1,30

|

1,32

|

1,42

|

1,42

|

|

Croissance des BPA (%)

| | |

21,6

|

0,00

|

1,85

|

7,81

|

-0,27

|

|

Dividende net (€)

| | |

0,28

|

0,28

|

0,28

|

0,28

|

0,28

|

|

Chiffre d'affaires (M€)

| | |

1 694

|

1 687

|

1 749

|

1 840

|

1 985

|

|

Marge d'EBITDA/R (%)

| | |

24,3

|

24,1

|

23,7

|

23,4

|

22,7

|

|

Résultat net pdg (M€)

| | |

202

|

202

|

205

|

222

|

221

|

|

ROE (après impôts) (%)

| | |

14,0

|

12,5

|

11,5

|

11,5

|

10,5

|

|

Taux d'endettement (%)

| | |

-10,4

|

-14,8

|

-18,9

|

-23,4

|

-28,0

|

|

Next Div. Indic 0,28 € payment 19/05/2026

|

|

Potentiel

17,2 %

Cours (€)

18,86

Capi (M€)

3 001

|

|

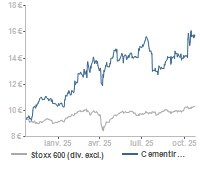

Perf. 1S:

|

1,73 %

|

|

Perf. 1M:

|

15,3 %

|

|

Perf. 3M:

|

31,7 %

|

|

Perf Ytd:

|

82,5 %

|

|

Perf. relative/stoxx600 10j:

|

4,97 %

|

|

Perf. relative/stoxx600 20j:

|

5,49 %

|

|